Black Swans and Actuaries

Black swan events are not new to the insurance industry nor are they new to world.

The term “black swan” was coined by Nassim Taleb in 2007. Taleb is a well-known statistician, risk analyst, author and hedge fund manager. He wrote “The Black Swan” as part of his series of tomes that investigate and discuss matters of probability, uncertainty, human nature and risk generally, with a focus on how decisions are made in an environment we do not or cannot ever fully understand.

Since Taleb’s use of the phrase, society increasingly refers to unpredictable – and sometimes unforeseeable – events as black swans. Criteria for such an event are that it:

- Is an outlier outside the range of reasonable expectations

- Has an extreme impact

- Is difficult to explain or quantify prospectively

Some may advocate a much more succinct definition – an unknown unknown. Essentially, the core of the definition of a black swan relates to matters we have never observed before or that are considered unforeseeable.

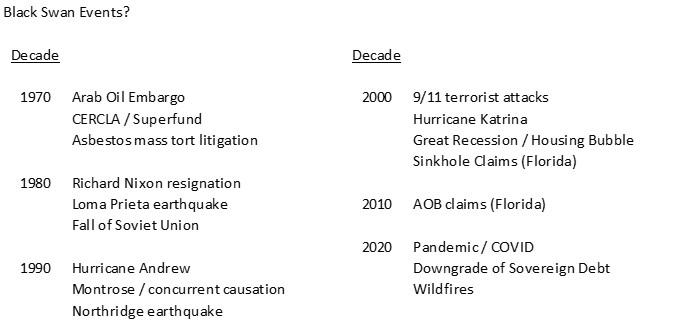

But are the recent happenings we often consider black swans really black swan events? The insurance industry generally, and actuaries in particular, deal with risk and uncertainty every day. What events may be deemed black swans? Consider:

The two “events” deemed a black swan in the insurance world include the emergence in the late 70s and early 80s of asbestos and environmental impairment liability (EIL) litigation (collectively, A&E). Prior to 1994, most insurance carriers had not booked any accruals for the future cost of such claims due to assertions that such were not quantifiable. Supporting that viewpoint was both FAS 5 and statutory accounting that both require two conditions must exist to support any accrual for unknown events. First, reserves may be set if it is probable an event has occurred, and secondly, its cost can be reasonably estimated.

An initial tool was developed by the A. M. Best organization in its March 1994 seminal special report titled “Environmental/Asbestos Liability Exposures: A P/C Industry Black Hole.” The “survival ratio” was presented as the number of years it would take a company to exhaust it present EIL reserves based on the current rate of claims payouts.

Unbeknownst to many, companies were confidentially reporting their A&E payments to A. M. Best beginning with data in 1990. From this data, the earliest estimates of the indicated accruals for unpaid A&E liabilities was in the range of $55 to $623 billion in nominal terms with an expected value of $260 billion. We note that through year-end 2023, the restated net A&E amounts realized since then total $91 billion. This amount represented about ½ of the aggregate surplus of the P/C insurance industry at year-end 1994.

In the current day, the wildfires in Los Angeles may seem to qualify, but such wildfires in the western United States and Canada are common. Clearly, conflagrations in populated areas such as Pacific Palisades or Lahaina are not frequent events but they are not uncommon.

Were embargoes and disruptions in the supply of crude oil like we experienced in the 1970s really unforeseeable? Despite the tremendous economic impact such actions had on western economies, one could argue the new market dynamic associated with increasing worldwide demand and the realization of the economic leverage held by various states in the Arabian Gulf made such disruptions reasonably possible.

The emergence of mass tort litigation involving EIL, tobacco and asbestos in the early 1980s was a new phenomenon. Prior to that time, mass torts involving toxic exposure and product liability, however, were commonly associated with disasters (many involving plane crashes).

It is arguable whether development in the mass tort environment were precursors to the nuclear and thermonuclear verdicts in the present day. To residents of the state of Florida, emergence of litigation involving sinkholes and assignment of benefits (AOB) probably feel like black swan events.

Hurricanes occur frequently, but the widespread damage from Hurricane Andrew in August 1992 fundamentally changed the insurance industry’s approach to dealing with exposure concentrations and the development of catastrophe modeling. Then again, there have been almost two dozen Category 5 hurricane events in the western hemisphere in the intervening 32 years.

Moreover, there were nine Category 5 hurricanes that made landfall in or around the United States in the 40-year period from 1960 to 1990. Insurance types talk about how Hurricane Andrew was a “game-changer” given the damages it caused and the proximity to Miami-Dade. But was it not foreseeable?

Major earthquakes and volcanic eruptions are rare in the United States, but such events are clearly predictable. We just have difficulty predicting where and when.

To say the September 11, 2001, attacks were unexpected is an understatement, but viewed in retrospect, there was a bombing at the World Trade Center garage in February 1993. Furthermore, airliners being hijacked were a very common occurrence; in the five years from 1968 to 1972, there were more than 300 reported hijacking incidents. Legitimate differences of opinion surround the predictability of 9/11 occurring, much less its impact on the United States.

From my experience of 45 years, it appears the enormous challenges faced both by the insurance industry generally, and actuaries in particular, were both foreseeable and predictable when viewed in retrospect. Without a doubt, few would have been able to predict the retroactive liability associated with the mass torts imposed by statutory actions and judicial decisions in the early 1980s.

Black swans are deemed a reality of our daily lives. However, it is difficult to know when such an event may occur or what it may look like. But we do know that they are very real.

Despite our personal views as to characteristics of this reality, fortuitous events that adversely impact the insurance industry in a significant way are always emerging. And we know that the future will pose even greater challenges to the industry. Executives with the foresight to see around the corners of the future and anticipate such challenges will be well prepared to keep their companies financially solid.