Fight, Flight or Adapt: Approaches to New Micro-captive Regulations

Two primary physiological responses an organism can have when facing a perceived threat are fight or flight. However, over time, many organisms adapt to changes in their environment. Similarly, it seems appropriate to classify the strategies that captive insurance companies making 831(b) elections, along with their managers, are likely to adopt in response to perceived threats of new IRS regulations.

What’s the Big Deal?

In January of this year, the IRS announced new regulations that amend the U.S. Income Tax Regulations (26 CFR part 1) under Section 6011 of the Internal Revenue Code. The new regulations identify certain micro-captive transactions and substantially similar transactions as listed transactions, and others as transactions of interest. These regulations were hotly contested and disputed when they were initially implemented on November 21, 2016, as Notice 2016-66, which was subsequently set aside by the U.S. Supreme Court in CIC Services, LLC vs. IRS. When the IRS again proposed similar regulations on April 23, 2023, there were 110 public comments prior to the public hearings. These comments were from professional associations, state insurance departments, captive associations, individual captive managers, captive owners and many others.

Some definitions of the IRS terminology may be beneficial. A “listed transaction” is “a reportable transaction which is the same as, or substantially similar to, a transaction specifically identified… as a tax avoidance transaction.” In other words, the IRS has determined that tax avoidance is present in similar transactions. Similarly, a “transaction of interest” has “the potential for tax avoidance or evasion, but lack sufficient information.”

Since both listed transactions and transactions of interest are reportable transactions, additional information will be required from the taxpayer, and the transactions are potentially subject to additional regulatory oversight.

The rules impose a set of criteria to determine whether a captive insurance company meets the criteria for each classification. These criteria include:

- Listed transaction

- Captive provided financing “that did not result in taxable income or gain to the recipient,” typically a loan or guarantee during the most recent five (5) years, and,

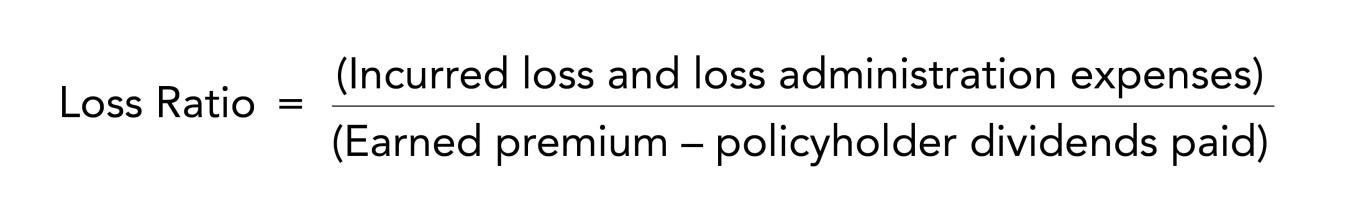

- Captive had a loss ratio (incurred loss and loss adjustment expenses divided by earned premiums less policyholder dividends) of less than 30% for the previous ten (10) year period.

- Transaction of interest

- Captive provided financing, loans, guarantees, etc., as described earlier during the most recent five (5) years, and/or,

- Captive had a loss ratio (as described earlier) of less than 60% for the previous ten (10) year period.

These rules only apply to captives making 831(b) elections. There are also exemptions for captives who have revoked their 831(b) election and captives that are “seller’s captives.” Sellers captives are those with 95% or more of premium related to providing insurance or reinsurance to unrelated customers. Sellers captives are common for service providers, contractors, auto dealers and retailers or wholesalers. Mutual insurance companies that make 831(b) elections but are not regulated as captive insurance companies are also not subject to the regulations.

Fighters

There are numerous captive associations, captive managers and owners that have actively fought the IRS’ regulatory attacks on captives generally, and micro-captives specifically, over the last decade or longer. When the IRS presented the draft versions of the new rules in 2023, they faced fierce opposition. There is no reason to believe that their opposition has wavered.

Several arguments were advanced against the rules during their exposure phase. Despite the IRS’ limited modifications of the regulations and stated rebuttals of comments, it stands to reason that the arguments will be raised again in the inevitable lawsuits challenging the rules. (In fact, the first lawsuit was filed against the regulations the very day they were announced.) The common points of those arguments have included:

- McCarran-Ferguson Act – McCarran-Ferguson, adopted in 1945, contains the basic delegation of authority from the U.S. Congress to the states regarding the regulation and taxation of the business of insurance.

- Overturn of Chevron Rule/legislative intent – In 2024, the Supreme Court struck down a decision related to a federal agency’s ability to interpret the laws they administer relative to their legislative intent.

- Discrimination – The IRS rules could be seen as a form of discrimination against small and medium businesses.

- Restraint of trade – There is concern that the new regulations inhibit state insurance departments from forming more captives in their captive domicile.

- Loss ratio test – There are concerns about 1) the appropriateness of any loss ratio requirement, and 2) the basis for the loss ratio standards set by the IRS.

- Loanbacks – Some professionals point to guidance from the National Association of Insurance Commissioners (NAIC) permitting properly structured loans to affiliates (e.g., at prevailing interest rates for similar transactions, with formal loan documents and payment schedules). As a result, they argue that properly structured loans should not be a criterion for a reportable transaction.

- Market comparable risk – In some cases, micro-captives that would be treated as listed transactions or transactions of interest provide coverage solely related to commercial insurance policies, such as deductible reimbursement coverage for trucking liability or medical professional liability.

Fleers

Since the initial 2016-66 regulations were released and the Avrahami decision was announced in August 2017, some captive owners have decided that maintaining their captive’s 831(b) election isn’t worth the effort. This does not mean that all of these owners have stopped using a captive for risk financing, but rather many have formed or joined a captive making an 831(a) election instead.

We expect that this trend will continue to expand as captive managers develop solutions to minimize the impact of conversions from 831(b) to 831(a). However, there will need to be some adjustments to some of these strategies due to IRS language regarding successors being subject to the new regulations. The new IRS rules define a successor as an entity that:

- directly or indirectly, acquires …the assets of another entity and succeeds to and takes into account the other entity’s earnings and profits or deficit in earnings and profits, or

- receives … any assets from another entity if such entity’s basis in such assets is determined, directly or indirectly, in whole or in part, by reference to the other entity’s basis in such assets.

It is beyond interesting that on January 13, 2025, essentially concurrent with the new regulations, the IRS also released Revenue Procedure 2025-13, with streamlined procedures for a taxpayer that has made an 831(b) election to obtain the automatic consent from the IRS to revoke such election. Clearly, the IRS is counting on increasing the number of captive owners who choose to flee.

Adapters

There are a large group of captive managers and owners who have dealt with the shifting landscape of IRS regulations of captive insurance companies for several years. These adapters are experienced, and some are quite adept at responding to new rules and requirements. In some respects, they are the most interesting group to examine in light of the new regulations. The good news is that there are numerous, field tested approaches to changing captives to be more in line with the IRS regulations. What are these kinds of adaptations?

It is important to remember that the loss ratio test is likely to be the main sticking point for many captives. The loss ratio has four main elements:

Consequently, there are four elements that can directly impact a micro-captives loss ratio: incurred losses, loss administration expenses, earned premium and policyholder dividends. It is important to consider how each of these four variables impact a captive’s loss ratio.

- Losses – To meet the IRS loss ratio requirement and not be considered a “transaction of interest” or “listed transaction”, a captive could consider adding lines of coverage with more frequent claims and higher loss ratios. This might be accomplished with coverages like auto physical damage, medical stop loss, ancillary employee benefits, warranty or assuming third party coverages via reinsurance. Adding deductible reimbursement coverage for commercial auto and workers compensation coverage have also been common approaches when adding higher frequency coverages to a captive.

- Loss administration expenses – Captives need to ensure that the expenses associated with claims administration are appropriately reflected in premiums and financial statements.

- Premium – Captives should be adjusting premiums to be responsive to statistically credible, favorable loss experience and consider adding coverages with higher loss ratios.

- Policyholder dividends – Captives can periodically pay policyholder dividends. This would increase the loss ratio calculated for the IRS rules.

Looking Forward

It is noteworthy that, despite the IRS’ fierce opposition of captives in general, and micro-captives in particular, both markets continue to grow. There are several reasons:

- Business owners continue to grow more risk savvy and knowledgeable about the benefits of captives.

- Business owners are frustrated with the increasing costs of commercial insurance, regardless of claims experience. This is particularly true in markets challenged by coverage availability or affordability issues.

- The ability of captives to both retain underwriting profits in years of favorable claims experience and have more control over claims handling strategies are compelling to many business owners.

In summary, are the new regulations going to cause some short-term disruption as captive owners elect to fight, flee or adapt? Absolutely. Are they going to materially impact the captive insurance industry or its continued growth and success? Absolutely not.

(published on Captive.com)