Pinnacle's 2022 RRG Benchmarking Study

On Pinnacle’s recent October APEX, our team presented an update of the highlights included in Pinnacle’s annual RRG Benchmarking Study. The full written study is available now for download on our website.

Pinnacle’s RRG study began as an article for an insurance journal addressing captive financial exam fees in 2015. At the time, we drew a correlation between RRGs and captive exam fees, because RRGs are typically regulated through a domicile’s captive insurance division. RRGs are required to file financials statements in a format mandated by the National Association of Insurance Commissioners (NAIC), so reviewers, researchers and professionals can access financial statements and analyze financial exam fees by RRG and domiciliary state.

We began updating the exam fee study annually, but in 2018 expanded it to include many more RRG specific benchmarks and demographics. Now in its fifth year, our study has grown into an invaluable resource of RRG benchmarks.

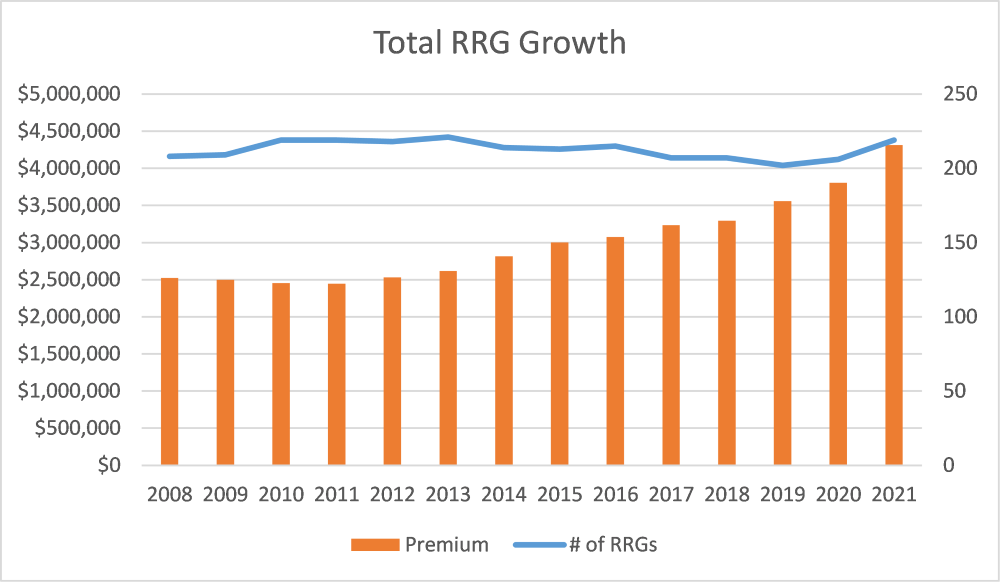

Premium volume for the RRG market has been growing. It took eight years for premiums to increase from $2.5 billion to $3.0 billion (2008 to 2015), but only six years to grow from $3.0 billion to $4.0 billion (2015 to 2021). Over this time-period the number of RRGs has remained relatively stable between 200 and 220 with and a number toward the high end of that range in 2022.

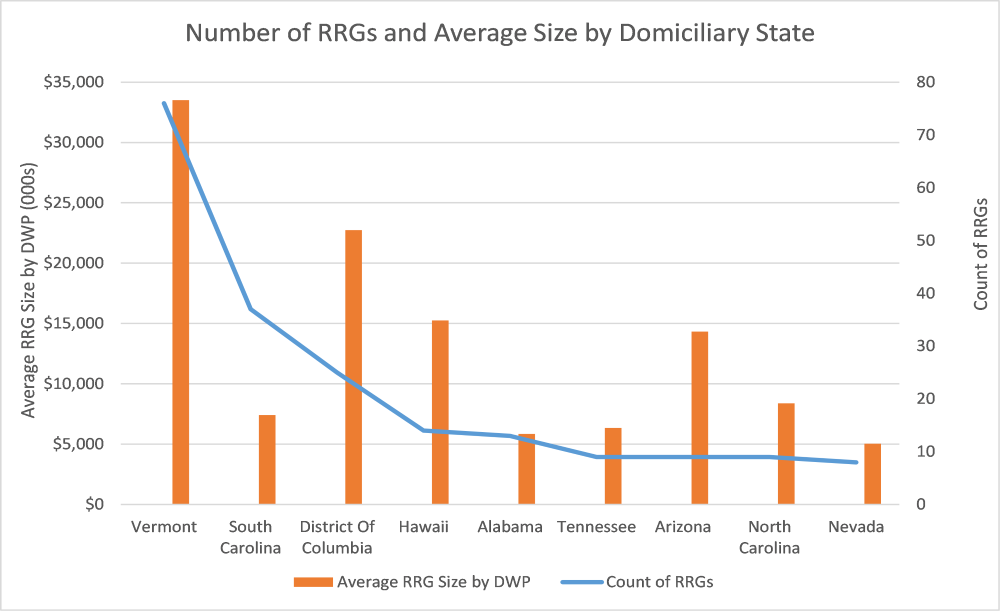

The current number of RRGs by domiciliary state and average size remains relatively consistent with prior studies. The State of Vermont is still the largest domicile, both in terms of the number of RRGs and premium volume.

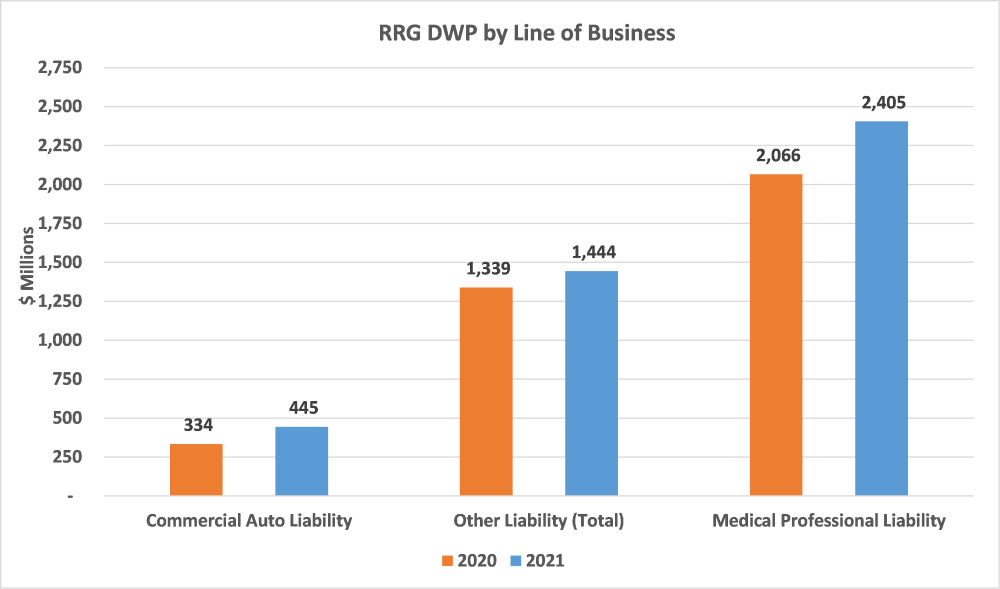

RRGs can only write liability coverages, which are dominated by commercial auto liability, other liability (both claims-made and occurrence forms), and medical professional liability (both claims-made and occurrence forms). Medical professional liability (MPL) is the largest line of business written.

Over the past few years, it’s been interesting to observe the RRG market grow as the insurance market has hardened and insurance coverage has become more difficult to purchase from commercial insurers. Access to coverage was why the Liability Risk Retention Act (LRRA) was initially passed back in 1986 and RRGs were subsequently formed. With the insurance market hardening and an increased number of RRGs, the need for industry-specific trends and benchmarks increases.

The above observations and conclusions provide just a sliver of the insights and are just a few highlights of Pinnacle’s RRG study, which contains additional information on:

- More Demographics

- Capitalization

- Operating Results

- Premium Trends and Benchmarks

- Loss and Loss Adjustment Expense Trends and Benchmarks

- Underwriting Expenses

- Investment Results

We encourage you to read more about the state of the RRG market! A free (registration required) copy of the 2022 RRG Benchmarking Study is available for download on our website.